Security and risks

All investments involve varying levels of risk, and investors’ risk tolerance differs. Learn more about the risks associated with investments and SaveLend, as well as how you can manage them.

By investing in loans for projects, you assume the full risk of the investment, including the risk of losing parts or all of the invested capital. The state deposit guarantee does not apply.

Any questions?

Here are some of the most common questions and concerns about the savings platform. If you have additional questions, feel free to contact us via chat, email, or phone.

-

How is the risk of SaveLend going bankrupt managed?

If, against all odds, SaveLend goes bankrupt, there are several safety measures for you as an investor, including:

1. SaveLend has permission via the Financial Supervisory Authority and it follows that it is the Financial Supervisory Authority that exercises supervision that SaveLend complies with the applicable rules and regulations. This takes place, among other things, through continuous reporting.

2. SaveLend has an independent internal auditor who ensures that the company has implemented routines and processes to ensure that we comply with applicable regulations.

3. SaveLend has a risk framework where the company's risks are managed and monitored continuously. This means that the risks would be flagged in good time before circumstances that could lead to bankruptcy could arise, and that measures to prevent this could be taken immediately.

4. SaveLend has an independent Risk function that reviews and follows up on the company's risk framework.

5. SaveLend has an authorized auditor who reviews the financial reports and follow-ups, to be able to take measures in good time if necessary.

6. You as an investor own the right of claim in the invested credit, not SaveLend. This means that you have the opportunity to get your investments back from the lender directly.

Read more about various securities and risks linked to investments in general and SaveLend in general on our page Security and risks. -

Is it a risk to invest with SaveLend?

All investing comes with some form of risk. Read more about security and risks associated with investments in general and SaveLend in particular on our page "Security and risks".

-

SaveLend’s risk rating – a tool for real estate investors

To support investors in real estate credits, SaveLend has developed a risk classification model with ratings ranging from A to F. Every real estate credit published on the platform is assigned a risk rating, designed to provide investors with a tool to better understand and compare different opportunities. This enables investors to select credits aligned with their individual risk tolerance and return expectations.

Because all underlying information is assessed in a consistent manner, investors gain the ability to make well-informed investment decisions and diversify their portfolios across different risk profiles. In this way, investors can build strategies that match both their risk appetite and long-term financial objectives. SaveLend is committed to offering a transparent and reliable risk classification framework, continuously updated and refined.

About the risk classification model

SaveLend’s risk classification model is an expert model – a qualitative framework designed to identify, assess, and prioritize risks in a systematic way. It is based on evaluations made by domain experts and estimates each project’s risk profile in relation to other projects on the platform.

It is important to note that the model serves only as a decision-support tool and not as an absolute measure. A high rating does not eliminate the possibility of credit losses, just as a lower rating does not necessarily imply that losses will occur. Therefore, investors should not rely solely on the risk rating but should also conduct their own evaluations of project elements such as business model, management expertise, market conditions, and other relevant factors.

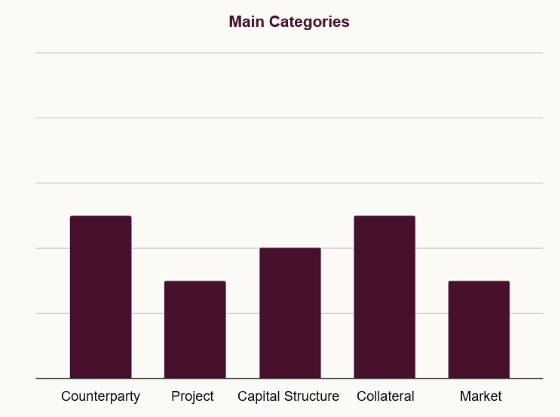

The model is structured around five main categories. Each category consists of underlying risk factors, which are aggregated and weighted to form a sub-score. These sub-scores are then combined into a final score, referred to as the anchor score. The five main categories are: Counterparty, Capital Structure, Collateral, Project, and Market. Their approximate weighting and overall descriptions are as follows:

Figure 1. The risk classification model and its approximate weighting between categories.

Figure 1. The risk classification model and its approximate weighting between categories.Counterparty

This category evaluates whether the borrower meets SaveLend’s requirements. Assessment is based on both quantitative financial parameters such as equity, years in operation, and external credit ratings, as well as qualitative parameters including experience and project execution capabilities. Findings from SaveLend’s background checks are also considered.

Capital Structure

Capital structure is assessed based on the project’s financial buffer and resilience in the event of delays or disruptions. Key ratios in this category include:

LTV (Loan to Value): The loan amount relative to the property’s current value, indicating collateral coverage in stressed scenarios.

LTC (Loan to Cost): The share of total project costs financed through debt. Lower LTC generally indicates stronger borrower commitment through equity contribution.

LTGDV (Loan to Gross Development Value): The loan relative to the total projected value, often equivalent to expected sales revenues.

Collateral

This category evaluates the quality of collateral, such as property pledges, share pledges, personal guarantees, or corporate guarantees. The position within the collateral structure (priority ranking) is especially important. The model also estimates the value of guarantees to provide the most accurate assessment possible.

Project

This category evaluates the project’s feasibility and current progress. For instance, a construction project that is already underway and has achieved sales milestones is generally considered lower risk than a project not yet initiated. The financial status of assigned contractors is also taken into account.

Market

Market conditions are critical in real estate credit assessments. Using up-to-date Swedish property market statistics, projects are evaluated based on location, pricing, and price trends.

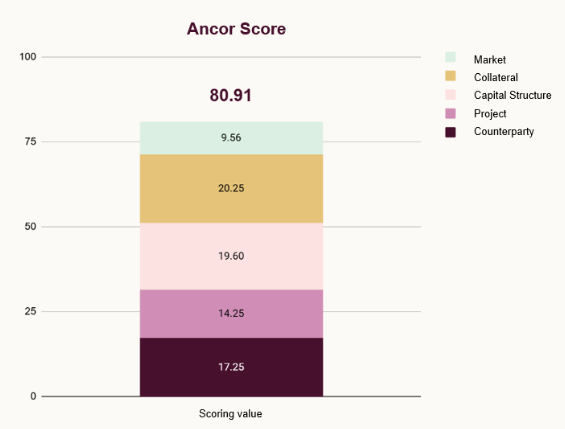

Figure 2. Example – the underlying risk factors in each main category equal the sum of 80.91 of the total maximum of 100 pointes (called anchor score) which translates into a risk rating B in this example.

Figure 2. Example – the underlying risk factors in each main category equal the sum of 80.91 of the total maximum of 100 pointes (called anchor score) which translates into a risk rating B in this example.From Anchor Score to Risk Rating

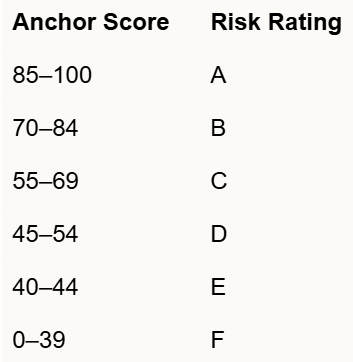

Each category score is aggregated into a total score (0–100), which forms the anchor score. This is then translated into a letter-based risk rating (A–F):

Risk Rating Definitions:

Risk Rating Definitions:A: Highest creditworthiness, low risk of default.

B: Strong creditworthiness, slightly higher risk than A but still considered low risk.

C: Good creditworthiness, moderate risk relative to B.

D: Acceptable creditworthiness, with higher sensitivity to market or economic changes.

E: Elevated credit risk, borrower is more vulnerable to external conditions.

F: Rejected. The project does not meet SaveLend’s fundamental requirements.

Risk ratings are also linked to interest levels: lower ratings (A, B) typically correspond to lower interest ranges, while higher ratings (D, E) involve higher return expectations, reflecting the associated risk. Projects rated F are automatically declined.

Interest Levels and Market Alignment

It is important to SaveLend that the interest rate on each credit reflects the assessed risk profile—both in comparison to other credits on the platform and to the broader market. While interest rates are influenced by market conditions and competition, they are ultimately anchored in the outcome of SaveLend’s risk classification model.

SaveLend’s Credit Committee

SaveLend applies a rigorous credit process for each real estate credit application. Only a small fraction of applications ultimately result in a published opportunity. Every project is thoroughly reviewed, including analysis of financials, contracts, contractors, management team, background checks, independent valuations, and local market conditions. Collateral requirements are strictly enforced, and valuations are always conducted by independent, often certified, appraisal institutes.

A key part of the process is the SaveLend Credit Committee, the decision-making body that must approve every credit before it is published. The committee ensures that lending is conducted responsibly and securely. It reviews all collected information, requests clarifications when necessary, and ultimately decides whether to approve or reject a credit.

The committee also confirms the proposed risk rating. If deemed necessary, it may apply a manual risk adjustment—raising or lowering the rating by one level to account for factors not fully captured by the model. The rating presented on the platform is always the final rating, inclusive of any committee adjustments.

-

Are my funds safe with SaveLend Fixed?

Your invested money in SaveLend Fixed is not covered by the state deposit guarantee. However, when you use SaveLend Fixed, your invested money is protected in such a way that you have a direct contractual claim against the borrowers. This means that it is the borrowers who are obligated to repay the money to you, and this obligation is not affected if, against all odds, SaveLend were to become insolvent.

In the event of bankruptcy, SaveLend will transfer the continued management of the platform to another party, who will then ensure that borrowers’ payments can continue as usual to you as an investor. If that party is unable to collect the claims, you will ultimately have the right to pursue the claims against the borrowers yourself. If SaveLend decides to wind down its operations, we will continue to manage the borrowers' payments to you as long as you have an outstanding claim.

Why doesn't SaveLend offer a State Deposit Insurance scheme?

Only accounts with credit institutions (i.e. banks and credit market companies) are covered by the State Deposit insurance. As SaveLend is not a bank or a credit market company, it is unfortunately impossible for us to offer this guarantee. However, this does not mean that your capital is unsafe with SaveLend, because of the model of a built-in capital protection.

Your money at SaveLend is protected differently depending on whether the capital is invested or not:

Non-invested capital

As SaveLend is a payment institution, we are required by law to always protect investors' money by keeping it in an account, completely separate from SaveLend's operations. We have no right to the capital even if we end up insolvent. This therefore applies if, for example, you have put money into the platform but have not yet chosen how it will be invested, or if the Fixed Interest Account has not yet been activated.

Invested capital

When you start using SaveLend's savings platform, the money is automatically invested for you as a customer. This also applies when you use the Fixed Interest Account. Once the money is invested, it is protected in such a way that you (and not SaveLend) have a direct right to your money vis-à-vis the person or company with whom the money was invested, as the loan agreement is written between lender and borrower. If SaveLend goes bankrupt, that right is not affected at all. Your capital is never counted as an asset for SaveLend and thus does not risk being included in the bankruptcy estate should SaveLend go bankrupt.

SaveLend has existed for ten years, is under the supervision of the Financial Supervisory Authority through several permits and is listed on Nasdaq First North. So, our business is under full transparency and control.

-

How do you check the companies that own projects?

SBL Finans AB (publ), which is a consumer credit institution, always conducts a thorough credit analysis of both the borrower and the specific project before any loan is brokered, regardless of whether it is real estate credits or other forms of loans. In case of real estate credits SBL Finans AB will also provide comprehensive documentation and materials.

This gives you as a potential investor the opportunity to independently carry out a thorough analysis of the project. The goal is to ensure that the proposed loan is consistent with your individual risk tolerance and investment strategy.

Reach your savings goals

Most people invest with a clear goal in mind. Whether it's buying a boat, saving for an apartment, or creating a more comfortable everyday life, it's inspiring to see how investments can bring you closer to your goal. To help you get where you want to be, we’ve put together four valuable tips to guide you along the way.

Spread your risks

One of the keys to successful saving is spreading your risks through diversification. By investing in various asset classes—such as stocks, funds, real estate, and fixed-income assets—you reduce the risk of a single asset negatively impacting your entire portfolio. Diversification allows you to balance higher return potential with stability, which is crucial for achieving your savings goals.

Think long-term

View your savings as a marathon, not a sprint. Thinking long-term and allowing your capital to grow over time can make a significant difference. Markets fluctuate, but with a long-term strategy and regular monthly saving, you can smooth out the ups and downs and benefit from all economic cycles. Be patient and avoid making decisions based on short-term market movements—this is the key to achieving your long-term savings goals.

Reinvest your returns

To maximize the return on your investments, reinvestment is a smart strategy. Instead of cashing out profits right away, let them work for you by reinvesting them. This strategy harnesses the power of interest-on-interest, meaning that your returns begin to generate returns of their own. In the long term, this can have a big positive impact on your capital and increase your chances of reaching your savings goals faster.

Set realistic goals

Having clear, realistic goals is essential to successful saving. Start by identifying what you want to achieve - perhaps a new home, more secure retirement or financial freedom - and create a plan for how to get there. Follow up your investments regularly and adjust the strategy if necessary. By having a concrete plan, you stay focused and motivated, which makes it easier to make informed decisions and reach your goals.

Riskspreading is our specialty

No investment is completely risk-free. Therefore, it is crucial to understand the risks and how they can be managed. Here at SaveLend, risk diversification is the core of our offer - so that you get stability in your savings.

Risk diversification means not putting all your eggs in one basket. We take this a step further by offering both several different credit types and smart, automated diversification solutions. When you invest with us, your capital is spread over hundreds of loans and credits, which means that every individual risk is limited. In combination with our wide range of credit types, you get both increased risk diversification and greater choice - simply and effectively.