Savings Strategies

Automated saving

Our saving strategies are designed for companies seeking an automated investment approach, tailored to the business’s return goals and risk level. Repayments and returns are automatically reinvested as long as the strategy is active, allowing you to take advantage of compound interest.

Let your money work for you

We make it easy to save with interest. Inspired by the business model of large banks, we have created interest savings where you lend money to businesses and individuals and earn returns in the form of interest. You can choose between two different saving strategies: Balanced and Yield. Both strategies invest capital in a wide range of credit types, offering good risk diversification and high stability. For over a decade, we’ve helped businesses and individuals achieve long-term sustainable savings.

Balanced

Recommended Saving Horizon: 12–36 months with an annual target return of 6.5–7.5%. Minimum investment 2,000 SEK.

High liquidity and stable returns

Low risk

Free secondary market (up to 50,000 SEK/year after 12 months)

The Balanced strategy is suitable for companies looking for stable returns and high liquidity. When choosing the Balanced strategy, capital is invested in a wide variety of low-risk credits with high cash flow.

Typically, interest payments are received monthly or quarterly. This strategy is also suitable for companies that want the option to withdraw invested funds. After each twelve-month period, you can sell investments up to 50,000 SEK free of charge.

Yield

Recommended Saving Horizon: 36+ months with an annual target return of 7.5–9.0%. Minimum investment 10,000 SEK.

High return

Medium risk

Perfect complement to the stock market

The Yield strategy is suitable for companies that want to achieve higher returns over time.

When choosing the Yield strategy, capital is invested in a wide range of credits expected to generate higher returns, with some volatility and varying cash flow (monthly, quarterly, annually, or longer). The higher annual target return is based on a saving horizon of 36 months or longer.

Invest safer

There is a close correlation between risk and return. To be comfortable with your investments, it is important to understand the risks involved and how to minimize them. This applies to investments made through SaveLend as well.

We have gathered both general risks and risks specific to SaveLend investments on the same page. Here, you can read more about how risks can be managed and spread to your advantage, so you can invest in a safer and more effective way.

Get started

Once you have created a SaveLend account with a company account, you can easily deposit money either as a one-time deposit or by starting a monthly savings plan. You can withdraw any uninvested money from your SaveLend account at any time.

The invested capital is paid back continuously from the respective loans. It is also possible to free up capital early by selling investments on our secondary market. You can always choose whether you want to reinvest the returns or transfer them to a bank account.

Do you have any questions?

Here are some of the most common questions and concerns about our savings strategies. If you have additional questions, feel free to contact us via chat, email, or phone.

-

Can I invest in loans available on SaveLend as a company?

Yes! You can smoothly and easily register a business account by:

Register an investor account as usual and complete the KYC (Know Your Customer) form.

Navigate to the Depot overview, click "My account" and then "Change depot".

Then click the "+" sign and "Add Company".

Follow the on-screen instructions to complete the registration of your business.

-

How do I make a deposit?

You can view the instructions for transferring money to your SaveLend account by logging in and navigating to "Deposit."

You can conveniently choose to transfer your money directly using Swish, Trustly, or by making a regular bank transfer.

To make a deposit, select your preferred deposit method from the list and follow the instructions.

Swish

Via Swish, your money arrives immediately. The regulations for the maximum amount and how much it’s possible to swish vary from bank to bank. Log into your internet or mobile bank to see and change your settings.Instant Bank payment via Trustly

Direct transfer via Trustly takes between 15 min and 1 banking day. It is an open banking payment method that allows customers to shop and pay from their bank account online, without using a card or app.Bank transfer

Bank transfers can take up to 1–3 days. Transfers must be made from a bank account that you own.

-

How do I withdraw capital?

You can easily request a withdrawal of uninvested funds by logging in to the interface.

Navigate back to the main menu and select "Withdraw." In the open window, enter the information about which account you want to withdraw from, the amount, and to which bank account.

Click "Continue" and answer the questions. End by confirming the withdrawal.

If you want to withdraw capital that is invested, you can sell your investments on the secondary market. Remember that sales on the secondary market include a fee except for special conditions for the Balanced savings strategy. Here, you have the right to sell investments up to a total of SEK 50,000 free of charge after every twelve months.

-

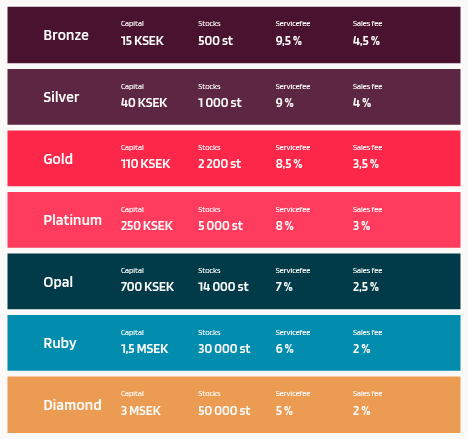

Do you have a bonus system for companies?

Yes, just as for our private savers, our corporate investors also have the opportunity to take part in our bonus system.

See the different levels and how they are achieved here Bonus system -

Can I choose which loans and loan types my company invests in?

We have three savings strategies for SEK depots that have different target returns.

Balanced is a savings strategy for you who want to minimize the risk of credit losses and have maximum liquidity in your savings. This strategy has a slightly lower target annual return and suits you who have a shorter savings horizon.

Yield is the savings strategy for you who aim for a higher return and who understand that this entails slightly higher risk and greater fluctuations in savings.

With the Freedom strategy, you can choose both the originator and the credit type and decide how much of your total capital can be placed in a single investment and get a higher or lower return depending on the settings.

Read more about our strategies here!

-

What fees does my company pay?

By default, SaveLend charges are 10% on all interest earned.

All investors on our platform, on the other hand, have the opportunity to use our bonus system to reduce this to low 5% through, for example, share ownership (in SaveLend's listed share YIELD) or by investing different levels on our platform: