Saving with interest made easy

Inspired by the business models of major banks, we’ve created interest-based savings where you earn ongoing returns through loans to businesses and individuals. For over a decade, we’ve helped thousands of clients achieve long-term, sustainable savings.

Why SaveLend?

This is why our customers choose SaveLend

Our customers talk about stable returns, secure savings, and easy usage – see what they have to say!

The best of both worlds

SaveLend was founded in the search for a robust savings option outside the volatility of the stock market. The solution became a range of savings products more stable than the stock market, with returns far exceeding those of traditional bank accounts.

A complement that offers smoother value growth, shorter downturns, and less dependence on individual assets. Simply the best of both worlds.

The smart alternative

Our technology enables savings where you invest in many small portions of loans and credits. Returns are automatically reinvested for a compound interest effect. With this model, you spread your risks and achieve diversification away from the stock market without needing to delve into complex information or constantly make adjustments yourself.

Our savings products

Discover our savings products created to make saving with interest easy and convenient. Choose the option that suits you best!

Calculate your savings

Compound interest

Our products deliver solid returns year after year. When your capital is put to work and returns are reinvested over time, the compound interest effect ensures your capital grows significantly.

The return is calculated based on an annual return of 7 percent. Note that past performance is not a guarantee of future results. Your capital may increase or decrease in value, and there is no guarantee that you will recover the entire amount invested.

Expected value year

with the Balanced strategy

You’re five minutes away from saving!

You can get started with us, quickly and securely in just five minutes!

Any questions?

Here are some of the most common questions and concerns about the savings platform. If you have additional questions, feel free to contact us via chat, email, or phone.

-

How do I make a deposit?

You can view the instructions for transferring money to your SaveLend account by logging in and navigating to "Deposit."

You can conveniently choose to transfer your money directly using Swish, Trustly, or by making a regular bank transfer.

To make a deposit, select your preferred deposit method from the list and follow the instructions.

Swish

Via Swish, your money arrives immediately. The regulations for the maximum amount and how much it’s possible to swish vary from bank to bank. Log into your internet or mobile bank to see and change your settings.Instant Bank payment via Trustly

Direct transfer via Trustly takes between 15 min and 1 banking day. It is an open banking payment method that allows customers to shop and pay from their bank account online, without using a card or app.Bank transfer

Bank transfers can take up to 1–3 days. Transfers must be made from a bank account that you own.

-

How do I withdraw capital?

You can easily request a withdrawal of uninvested funds by logging in to the interface.

Navigate back to the main menu and select "Withdraw." In the open window, enter the information about which account you want to withdraw from, the amount, and to which bank account.

Click "Continue" and answer the questions. End by confirming the withdrawal.

If you want to withdraw capital that is invested, you can sell your investments on the secondary market. Remember that sales on the secondary market include a fee except for special conditions for the Balanced savings strategy. Here, you have the right to sell investments up to a total of SEK 50,000 free of charge after every twelve months.

-

How do I sell investments on the secondary market?

At SaveLend, you have the opportunity to sell your investments on the secondary market if you want to free up your capital. Once logged in, select "Strategies," and then choose the account in which you want to sell credits. At the bottom under shortcuts, select "Sell credits." From there, filter the investments you want to sell and mark them using the checkbox. Then click on "Review." There, you can see how many credits you have chosen to sell and at what value, as well as the fee charged for your sale, along with the total sales value after fees have been deducted. When you click on "Confirm sale," the credits are listed on the secondary market.

Keep in mind that sales on the secondary market include a 5% fee and that your investments are not sold directly; it may take a day or two for your investment to be bought by other investors.

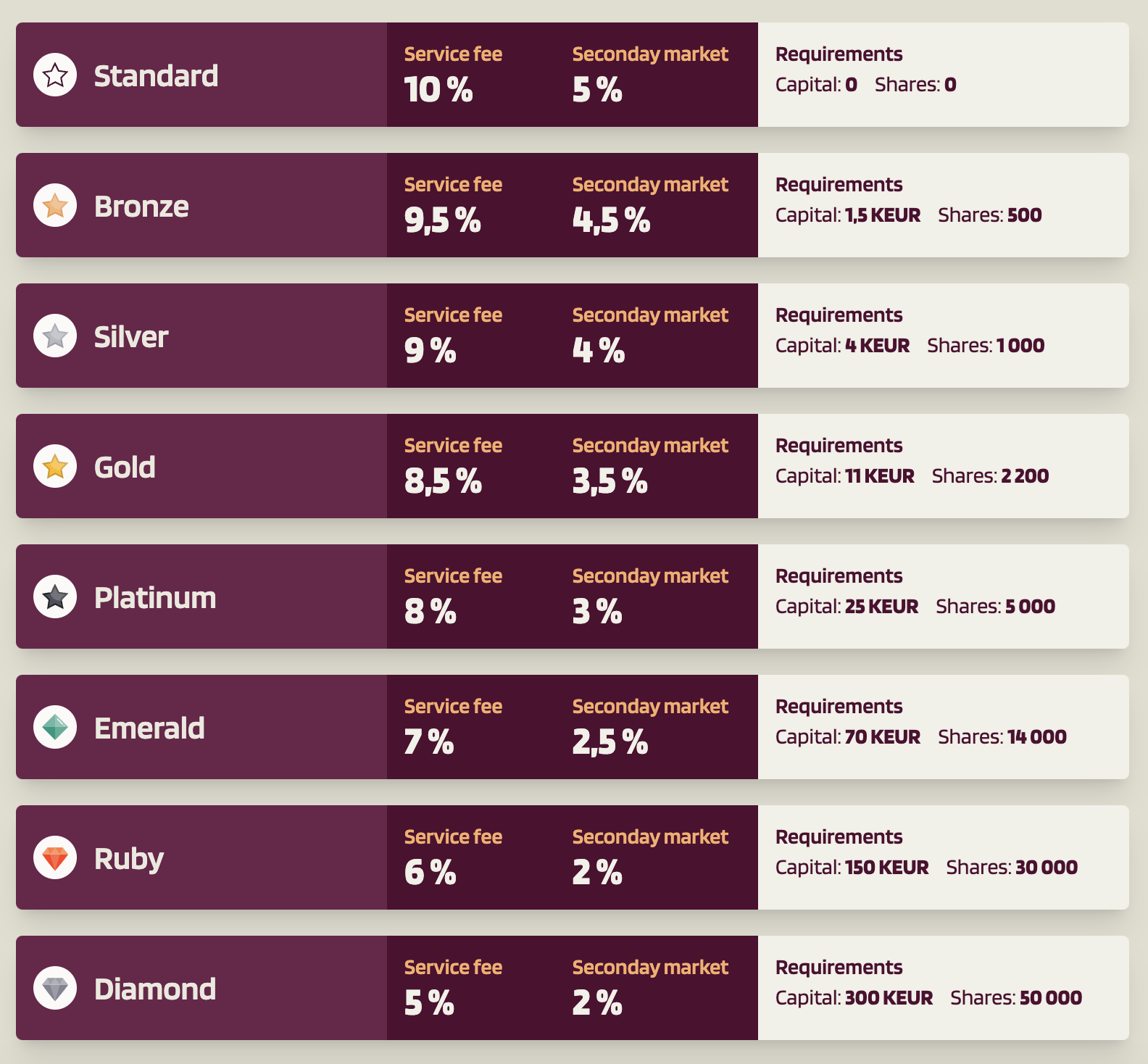

Depending on your bonus level, the fee may be less, up to 2%. Read more here Bonus system.

For the Balanced strategy, you also have the right to sell investments free of charge up to a total of SEK 50,000 after each twelve-month period.

-

Does the deposit guarantee apply with SaveLend?

Uninvested funds

The deposit guarantee means that you receive compensation from the state up to SEK 1,050,000 if the one with whom you keep your money goes bankrupt (insolvency). SaveLend provides investors with a payment account for deposits of funds to be invested on the platform. SaveLend's accounts are with Handelsbanken, and it is Handelsbanken and not SaveLend, which is covered by the government deposit guarantee. This means that your uninvested funds in SaveLend's payment account are protected up to SEK 1,050,000 in case Handelsbanken ends up insolvent.

NOTE, that the deposit guarantee applies per customer and bank. This means that if you are also a customer of Handelsbanken and have money in an account with Handelsbanken, your uninvested funds at SaveLend will be added together with your assets at Handelsbanken if the deposit guarantee is updated (and the total amount covered by the guarantee amounts to a maximum of SEK 1,050,000).

In case SaveLend ends up insolvent, the deposit guarantee does not apply, on the other hand, SaveLend's operations are subject to a statutory requirement to always keep received funds separate from its own funds, which means that the so-called right of separation always exists. This means that your uninvested funds are always protected and that you have the right to withdraw them in case SaveLend becomes insolvent. No maximum amount limit applies to such a right of separation.

Invested funds

If you have money invested on the platform, you have a direct contractual claim against the borrowers. This means that it is the borrowers, and not SaveLend, who are obliged to repay the money to you. That obligation is not affected if SaveLend ends up insolvent and you therefore have the right to continue to be paid by the borrowers, just as usual. In such a situation, SaveLend will entrust the continued management of the platform to another party, which ensures that the borrowers' payments can continue as usual to the investors.

Read more about Security and risks

-

How does SaveLend's bonus system work? Can I get reduced fees?

Yes, you can get lowered fees through our bonus system for investors. Currently, you can get a reduced service fee and fee on the secondary market based on how much you have invested or if you are a shareholder in SaveLend Group AB.

Keep in mind that the bonus level you adhere to is updated monthly as we receive updated information on invested capital and our shareholders. Note that only directly owned shares count towards the bonus levels.

See our bonus levels here.

-

"Refer-a-friend"

"Refer-a-friend" means that you as an investor can invite a friend, and both can then earn up to SEK 10,000 or EUR 1,000 in bonus.

To get the bonus, your friend needs to create an account via an exclusive referral link that you receive with your account (you can find the link in the section “My account” → “My bonuses”)

and then invest at least SEK 5,000 or EUR 500 within 30 days. The bonus is then paid out within 3 working days to both you and the invited friend.

"Refer-a-friend" only applies if you invite someone who starts investing in the strategies or projects. You do not receive a bonus when you invite someone who chooses to invest in a Fixed Interest Account.

The bonus ladder is as follows:

SEK 5,000 or more gives a bonus of SEK 200

SEK 10,000 or more gives a bonus of SEK 400

SEK 20,000 or more gives a bonus of SEK 600

SEK 100,000 or more gives a bonus of SEK 1,000

SEK 500,000 or more gives a bonus of SEK 5,000

SEK 1,000,000 or more gives a bonus of SEK 10,000

You can use your referral link an unlimited number of times.

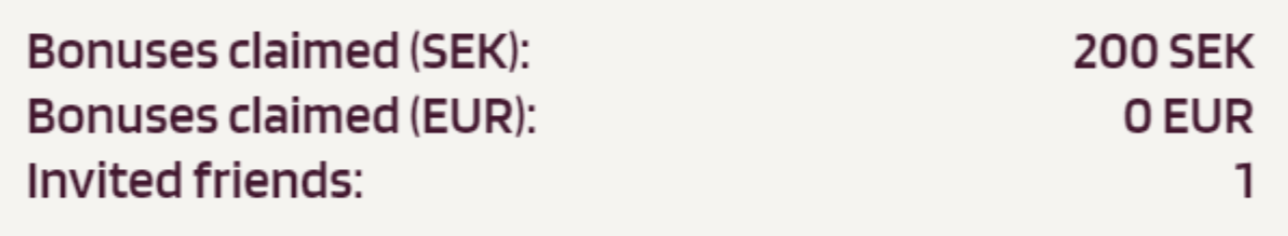

The bonus is paid for both SEK- and EUR-accounts. You can easily see paid bonuses and the number of invited friends on your account in the same section:

If you, who referred a friend, only invest in SaveLend Fixed, the bonus will be paid out to your Transfer depot.