SaveLend’s risk rating – a tool for real estate investors

To support investors in real estate credits, SaveLend has developed a risk classification model with ratings ranging from A to F. Every real estate credit published on the platform is assigned a risk rating, designed to provide investors with a tool to better understand and compare different opportunities. This enables investors to select credits aligned with their individual risk tolerance and return expectations.

Because all underlying information is assessed in a consistent manner, investors gain the ability to make well-informed investment decisions and diversify their portfolios across different risk profiles. In this way, investors can build strategies that match both their risk appetite and long-term financial objectives. SaveLend is committed to offering a transparent and reliable risk classification framework, continuously updated and refined.

About the risk classification model

SaveLend’s risk classification model is an expert model – a qualitative framework designed to identify, assess, and prioritize risks in a systematic way. It is based on evaluations made by domain experts and estimates each project’s risk profile in relation to other projects on the platform.

It is important to note that the model serves only as a decision-support tool and not as an absolute measure. A high rating does not eliminate the possibility of credit losses, just as a lower rating does not necessarily imply that losses will occur. Therefore, investors should not rely solely on the risk rating but should also conduct their own evaluations of project elements such as business model, management expertise, market conditions, and other relevant factors.

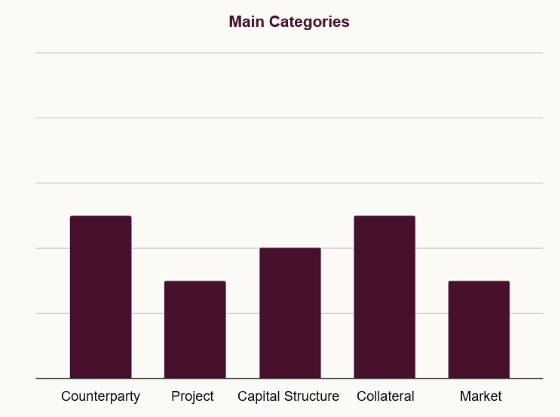

The model is structured around five main categories. Each category consists of underlying risk factors, which are aggregated and weighted to form a sub-score. These sub-scores are then combined into a final score, referred to as the anchor score. The five main categories are: Counterparty, Capital Structure, Collateral, Project, and Market. Their approximate weighting and overall descriptions are as follows:

Figure 1. The risk classification model and its approximate weighting between categories.

Figure 1. The risk classification model and its approximate weighting between categories.

Counterparty

This category evaluates whether the borrower meets SaveLend’s requirements. Assessment is based on both quantitative financial parameters such as equity, years in operation, and external credit ratings, as well as qualitative parameters including experience and project execution capabilities. Findings from SaveLend’s background checks are also considered.

Capital Structure

Capital structure is assessed based on the project’s financial buffer and resilience in the event of delays or disruptions. Key ratios in this category include:

LTV (Loan to Value): The loan amount relative to the property’s current value, indicating collateral coverage in stressed scenarios.

LTC (Loan to Cost): The share of total project costs financed through debt. Lower LTC generally indicates stronger borrower commitment through equity contribution.

LTGDV (Loan to Gross Development Value): The loan relative to the total projected value, often equivalent to expected sales revenues.

Collateral

This category evaluates the quality of collateral, such as property pledges, share pledges, personal guarantees, or corporate guarantees. The position within the collateral structure (priority ranking) is especially important. The model also estimates the value of guarantees to provide the most accurate assessment possible.

Project

This category evaluates the project’s feasibility and current progress. For instance, a construction project that is already underway and has achieved sales milestones is generally considered lower risk than a project not yet initiated. The financial status of assigned contractors is also taken into account.

Market

Market conditions are critical in real estate credit assessments. Using up-to-date Swedish property market statistics, projects are evaluated based on location, pricing, and price trends.

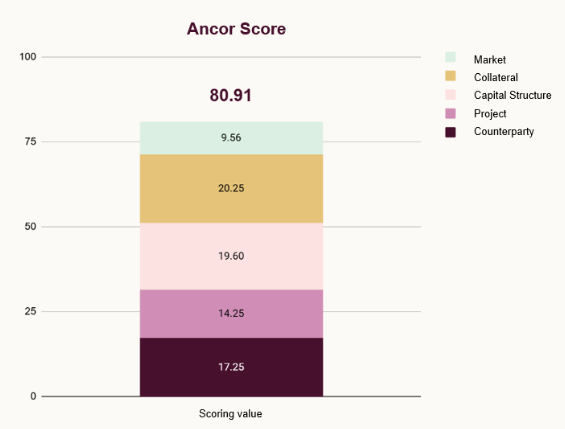

Figure 2. Example – the underlying risk factors in each main category equal the sum of 80.91 of the total maximum of 100 pointes (called anchor score) which translates into a risk rating B in this example.

Figure 2. Example – the underlying risk factors in each main category equal the sum of 80.91 of the total maximum of 100 pointes (called anchor score) which translates into a risk rating B in this example.

From Anchor Score to Risk Rating

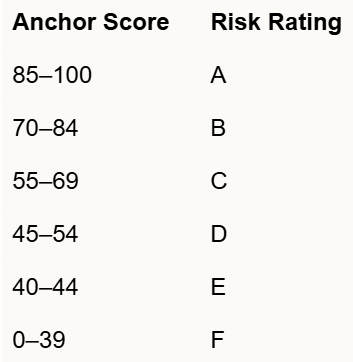

Each category score is aggregated into a total score (0–100), which forms the anchor score. This is then translated into a letter-based risk rating (A–F):

Risk Rating Definitions:

Risk Rating Definitions:

A: Highest creditworthiness, low risk of default.

B: Strong creditworthiness, slightly higher risk than A but still considered low risk.

C: Good creditworthiness, moderate risk relative to B.

D: Acceptable creditworthiness, with higher sensitivity to market or economic changes.

E: Elevated credit risk, borrower is more vulnerable to external conditions.

F: Rejected. The project does not meet SaveLend’s fundamental requirements.

Risk ratings are also linked to interest levels: lower ratings (A, B) typically correspond to lower interest ranges, while higher ratings (D, E) involve higher return expectations, reflecting the associated risk. Projects rated F are automatically declined.

Interest Levels and Market Alignment

It is important to SaveLend that the interest rate on each credit reflects the assessed risk profile—both in comparison to other credits on the platform and to the broader market. While interest rates are influenced by market conditions and competition, they are ultimately anchored in the outcome of SaveLend’s risk classification model.

SaveLend’s Credit Committee

SaveLend applies a rigorous credit process for each real estate credit application. Only a small fraction of applications ultimately result in a published opportunity. Every project is thoroughly reviewed, including analysis of financials, contracts, contractors, management team, background checks, independent valuations, and local market conditions. Collateral requirements are strictly enforced, and valuations are always conducted by independent, often certified, appraisal institutes.

A key part of the process is the SaveLend Credit Committee, the decision-making body that must approve every credit before it is published. The committee ensures that lending is conducted responsibly and securely. It reviews all collected information, requests clarifications when necessary, and ultimately decides whether to approve or reject a credit.

The committee also confirms the proposed risk rating. If deemed necessary, it may apply a manual risk adjustment—raising or lowering the rating by one level to account for factors not fully captured by the model. The rating presented on the platform is always the final rating, inclusive of any committee adjustments.