Savings Strategies

Automated savings

Our savings strategies are perfect if you are looking for an automated savings plan tailored to your return expectations and risk tolerance. Repayments and returns are automatically reinvested as long as you keep your strategy active, allowing you to benefit from the compound interest effect.

Let the money work for you

We make it easy to save with interest. Inspired by the business models of major banks, we’ve created interest-based savings where you lend money to businesses and individuals and earn returns in the form of interest. You can choose between two different savings strategies: Balanced and Yield. Both strategies involve investing your money in a wide range of credit types, providing good diversification and high stability. For over a decade, we’ve helped thousands of Swedes achieve long-term, sustainable savings.

Balanced

Recommended savings horizon: 12+ months with an annual target return of 6,5–7,5 %. Minimum investment 2,000 SEK.

High liquidity and stable returns

Low risk

Free secondary market (SEK 50,000/year after 12 months)

The Balanced strategy is suitable for investors looking for stable returns and high liquidity. By choosing the Balanced strategy, your capital is invested in a wide range of credits with low credit loss risk and high cash flow.

Typically, you will receive interest payments monthly or quarterly. This strategy is also suitable for those who want the option to withdraw invested funds if necessary—after each 12-month period, you have the right to sell investments up to SEK 50,000 without any fees.

Yield

Recommended savings horizon: 36+ months with an annual target return of 7,5–9 %. Minimum investment 10,000 SEK.

Higher returns

Medium risk

Perfect complement to the stock market

The Yield strategy is suitable for investors seeking higher returns over time.

By choosing the Yield strategy, your capital is invested in a wide range of credits with expected higher returns, some volatility, and varying cash flow (monthly, quarterly, annually, or longer). The higher annual target return is based on a savings horizon of 36 months or longer.

Invest smarter and safer

There is a close relationship between risk and return. To feel confident with your savings, it’s important to understand the risks involved and how to minimize them. This also applies to the investments you make with us at SaveLend.

That’s why we’ve gathered both general risks and risks specific to investments at SaveLend on one page. There, you can learn more about how risks can be managed and diversified to your advantage, allowing you to save money in a safer way.

Get started

Once you’ve created a SaveLend account, you can easily deposit funds by making either a one-time deposit or starting a monthly savings plan. You can withdraw uninvested funds from your SaveLend account at any time.

Your invested capital is repaid continuously from the respective loans. You can also release capital early by selling your investments on our secondary market. You can always choose whether to reinvest your returns or transfer them to your bank account.

Do you have any questions?

Here are some of the most common questions and concerns about our savings strategies. If you have additional questions, feel free to contact us via chat, email, or phone.

-

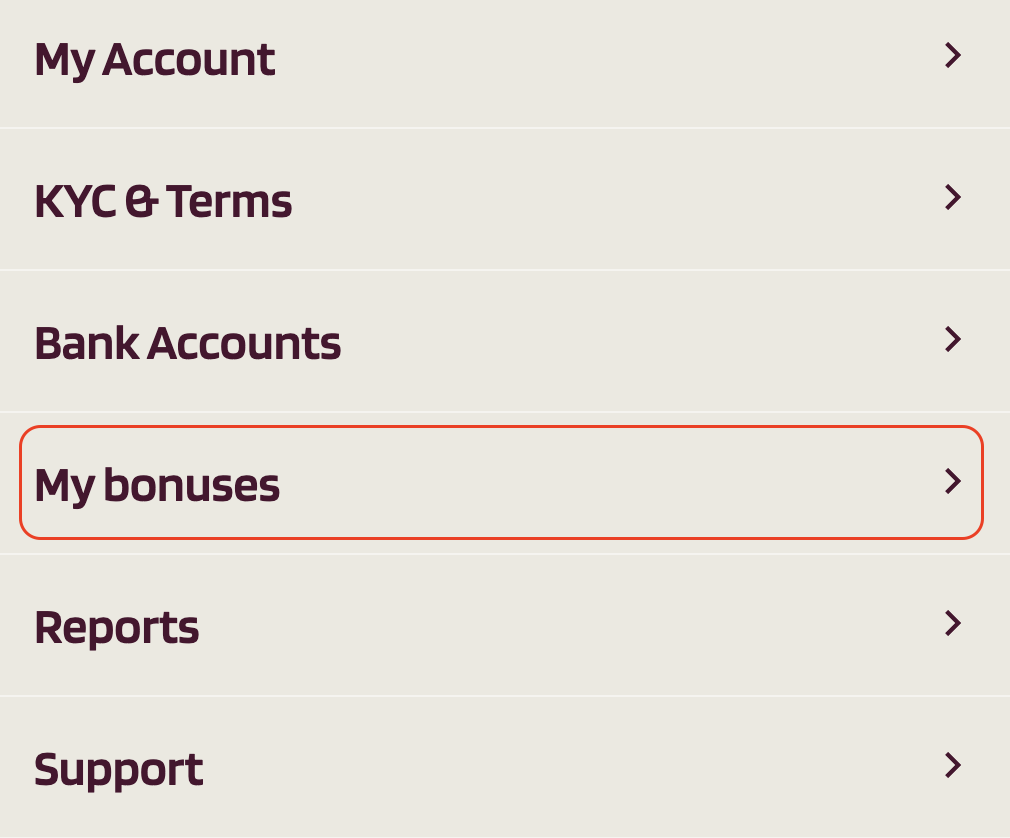

Did I set up my SaveLend account correctly?

An account at the SaveLend platform is a place where you can store and manage your financial assets. An account is automatically created for each selected strategy. The number of accounts is not limited. Available currencies for accounts with us are SEK and EUR.

We all have different possibilities and goals regarding our savings and our investments. Therefore, "correctly set up” depends entirely on your own choice. As long as you have chosen and activated the right strategy for you, have approved all the terms and conditions, filled in the KYC (Know Your Customer) information, and made your first deposit – then we guarantee that you are on the right track!

-

How do I make a deposit?

You can view the instructions for transferring money to your SaveLend account by logging in and navigating to "Deposit."

You can conveniently choose to transfer your money directly using Swish, Trustly, or by making a regular bank transfer.

To make a deposit, select your preferred deposit method from the list and follow the instructions.

Swish

Via Swish, your money arrives immediately. The regulations for the maximum amount and how much it’s possible to swish vary from bank to bank. Log into your internet or mobile bank to see and change your settings.Instant Bank payment via Trustly

Direct transfer via Trustly takes between 15 min and 1 banking day. It is an open banking payment method that allows customers to shop and pay from their bank account online, without using a card or app.Bank transfer

Bank transfers can take up to 1–3 days. Transfers must be made from a bank account that you own.

-

How do I withdraw capital?

You can easily request a withdrawal of uninvested funds by logging in to the interface.

Navigate back to the main menu and select "Withdraw." In the open window, enter the information about which account you want to withdraw from, the amount, and to which bank account.

Click "Continue" and answer the questions. End by confirming the withdrawal.

If you want to withdraw capital that is invested, you can sell your investments on the secondary market. Remember that sales on the secondary market include a fee except for special conditions for the Balanced savings strategy. Here, you have the right to sell investments up to a total of SEK 50,000 free of charge after every twelve months.

-

How does monthly savings work?

Save a selected amount that is withdrawn via direct debit every month. You can also have several monthly savings divided into different accounts in which you have your investments.

Select under "Strategies" which account you want to set up monthly savings for.

Click the "Get Started" button under "Monthly Savings."

Follow the instructions that appear.

Then click the "Start Saving" button.

Monthly savings with SaveLend is perfect for:Build your savings without having to think about it

Save valuable time by having your money deposited automatically

Invest on an ongoing basis – without involvement*

Spread your risks automatically

Get interest-on-interest from your investments

*Does not apply to deposits from Svensk Kreditförmedling AB and Lunar A/S. -

Am I, as an investor, exposed to different borrowers in each investment opportunity?

It varies from case to case, depending on the loan type and/or lending company. For example, for consumer loans via the lending company SBL Finance, it is common to only be exposed to one investment per borrower, but for factoring from the same lending company, the same borrowing company can use the service several times. In general, it depends on the underlying securities of each specific loan.

-

"Refer-a-friend"

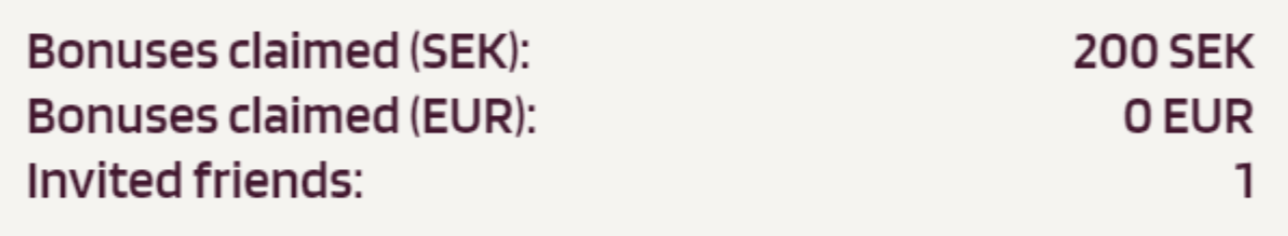

"Refer-a-friend" means that you as an investor can invite a friend, and both can then earn up to SEK 10,000 or EUR 1,000 in bonus.

To get the bonus, your friend needs to create an account via an exclusive referral link that you receive with your account (you can find the link in the section “My account” → “My bonuses”)

and then invest at least SEK 5,000 or EUR 500 within 30 days. The bonus is then paid out within 3 working days to both you and the invited friend.

"Refer-a-friend" only applies if you invite someone who starts investing in the strategies or projects. You do not receive a bonus when you invite someone who chooses to invest in a Fixed Interest Account.

The bonus ladder is as follows:

SEK 5,000 or more gives a bonus of SEK 200

SEK 10,000 or more gives a bonus of SEK 400

SEK 20,000 or more gives a bonus of SEK 600

SEK 100,000 or more gives a bonus of SEK 1,000

SEK 500,000 or more gives a bonus of SEK 5,000

SEK 1,000,000 or more gives a bonus of SEK 10,000

You can use your referral link an unlimited number of times.

The bonus is paid for both SEK- and EUR-accounts. You can easily see paid bonuses and the number of invited friends on your account in the same section:

If you, who referred a friend, only invest in SaveLend Fixed, the bonus will be paid out to your Transfer depot.