SaveLend for

institutional investors

-

Since the start, the savings strategies have delivered a stable return in line with the target returns

-

Safe and secure - invest with high risk diversification

-

Simple and smooth - fully automated and basis for bookkeeping

-

Favourable and smart - no provisional tax and possibility of tax advantages

Tailor-made investment solutions

SaveLend offers great opportunities to tailor investment solutions based on your needs.

In addition to the investment choices available to all SaveLend investors, institutional investors can tailor their investments even more to find the perfect solution for their clients.

Do you want an investment with continuous payouts? Or just a loan type or currency?

Please contact institutional@savelend.se and we will find a solution!

Create account today!

-

Create an account as a private individual at SaveLend

-

Navigate to the depot selector at the top right of the page, click the “+” button and select “Register Company”

-

Transfer any amount

-

Use our default settings or tailor your investment strategy

-

Your money is automatically invested

Frequently asked questions

Below you will find frequently asked questions and answers related to how you invest as a Business or Institution at SaveLend.

Not finding the question you're looking for? Here you will find more questions and answers!

-

As a business investor, no tax is automatically deducted from your investments - so you get the opportunity to enjoy an "interest-on-interest" effect on all your returns.

-

By default, SaveLend charges are 10% on all interest earned.

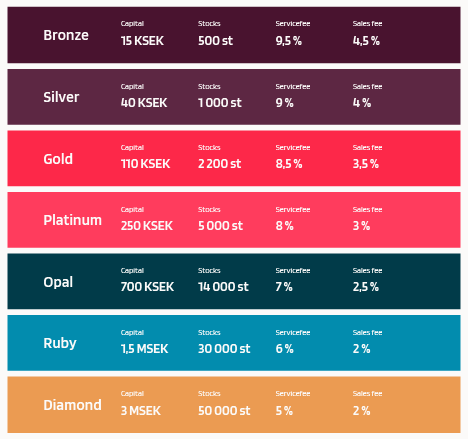

All investors on our platform, on the other hand, have the opportunity to use our bonus system to reduce this to low 5% through, for example, share ownership (in SaveLend's listed share YIELD) or by investing different levels on our platform:

-

As an investor at SaveLend, you have the opportunity to tailor the types of loans and loan intermediaries in which your capital is invested.

-

You can withdraw any of the company's funds that are not invested in credits at any time.

Börja investera

For the capital tied up in investments, we offer a secondary market where the loans can be sold to other investors for a fee to free up capital, which in turn can be withdrawn. -

Yes, just as for our private savers, our corporate investors also have the opportunity to take part in our bonus system.

See the different levels and how they are achieved below:https://savelend.se/en/bonus-system-savelend

-

Please contact us at sales@savelend.se if you want to transfer your depot to someone else.

Börja investera -

It is excellent to register your company as dormant according to the so-called 5:25 rule and invest the capital from the sale at SaveLend.

Börja investera

The tax effects that arise depend on the circumstances of the individual case. On www.skatteverket.se you can read more about the conditions that need to be met to take advantage of the favourable tax rules for dormant companies.

With SaveLend, you can grow your capital by either adapting your investment strategy entirely yourself based on your wishes in terms of risk and potential return, or using our tools to manage all investments completely automatically.

Any questions? Send an email to sales@savelend.se! -

It's just as easy to invest as a business or institution on our investment platform, as for a private individual. You can also export reports with detailed information on all transactions made on the platform. You can then use these as a basis for your company's accounting (SIE4 files). Börja investera